Gold Smuggling Cases in India: An Overview of Laws and Procedures under the Customs Act, 1962

Written by Adv Ashish Panday (Legum Attorney Customs Law Firm )

Introduction

Gold Smuggling is a criminal offence in India and there are different Central laws which prevent and prohibit the same. Gold smuggling remains a significant concern for India, given its economic impact and potential threats to national security. The Customs Act, 1962, plays a pivotal role in regulating and combating such illicit activities. This article explores the laws and procedures established under the Customs Act, 1962, pertaining to gold smuggling cases in India.

What are the Central Laws on Gold Smuggling in India?

- Custom Act (CA), 1962

- Foreign Trade (Development & Regulation) Act, 1992

- Conservation of Foreign Exchange and Prevention of Smuggling Activities Act (COFEPSA), 1974

- Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act (SFEMA), 1976

- Unlawful Activities (Prevention) Act [UAPA], 1967

Customs Act, 1962:

The Customs Act, 1962, is a comprehensive legislation that empowers the government to regulate the import and export of goods and to prevent illegal activities, including smuggling. When it comes to gold smuggling cases, the Customs Act provides the legal framework for investigation, prosecution, and adjudication.

Types of Cases

- Green Channel violation

- Seizure cases

Also Read: What To Look For In A Customs Lawyer?

Key Provisions:

- Section 11: Prohibition on Import or Export of Goods:

- This section empowers the government to prohibit or restrict the import or export of certain goods, including gold, to safeguard national interests.

- Section 12: Powers of Customs Officers:

- Customs officers are granted extensive powers under this section, including the authority to search and seize goods, examine persons, and detain individuals suspected of being involved in smuggling activities.

- Section 108: Power to summon persons to give evidence and produce documents

- Section 110: Seizure of goods, documents and things

- any goods are liable to confiscation under this Act

- Section 135: Smuggling:

- This section specifically deals with the offense of smuggling and prescribes severe penalties, including imprisonment and fines. Gold smuggling cases fall under the purview of this section.

- Section 136: Abetment of Smuggling and Cognizable Offenses:

- Any person who abets or is knowingly concerned in any offense under Section 135 is also liable for prosecution. The Act treats such offenses as cognizable, allowing for immediate arrest.

Punishment and Penalties in Gold Smuggling Cases

Types of Punishments

The Customs Act envisages two types of punishments:

(a) Civil Liability: Penalty for violation of statutory provisions involving a penalty of money and confiscation of goods, which can be imposed by the departmental authorities. Chapters XIV of the Customs Act (Sections 111 to 127) deals with confiscation of goods and conveyances and imposition of penalties.

(b) Criminal Liability: Criminal punishment is of imprisonment and fine; which can be granted only in a criminal court after prosecution. Both penalty and punishment can be imposed for same offence. Chapter XVI (Sections 132 to 140A) deals with other offences under the Act.

The provisions dealing with confiscation of goods and conveyances and imposition of penalty are contained in sections from 111 to 127 of the Customs Act, 1962.

Procedures for Gold Smuggling Cases:

- Detection and Seizure:

- Customs officials use intelligence inputs, surveillance, and profiling to identify potential gold smuggling cases.

- Suspected individuals or consignments are subject to thorough examination, including physical searches and the use of advanced screening technologies.

- Arrest and Interrogation:

- If evidence suggests involvement in gold smuggling, the Customs Act empowers officers to arrest the accused.

- Interrogation follows the arrest to gather information about the smuggling network, modus operandi, and other key details.

- Adjudication:

- Adjudication is a quasi-judicial process where an officer, known as the adjudicating authority, examines the evidence and determines the extent of the violation.

- Penalties, including fines and confiscation of the smuggled gold, are imposed based on the severity of the offense.

- Prosecution:

- In cases where the offense is deemed serious, criminal prosecution may be initiated under Section 135 of the Customs Act.

- The accused may face trial in a court of law, leading to imprisonment and additional fines upon conviction.

Customs Lawyer/ Customs Advocate

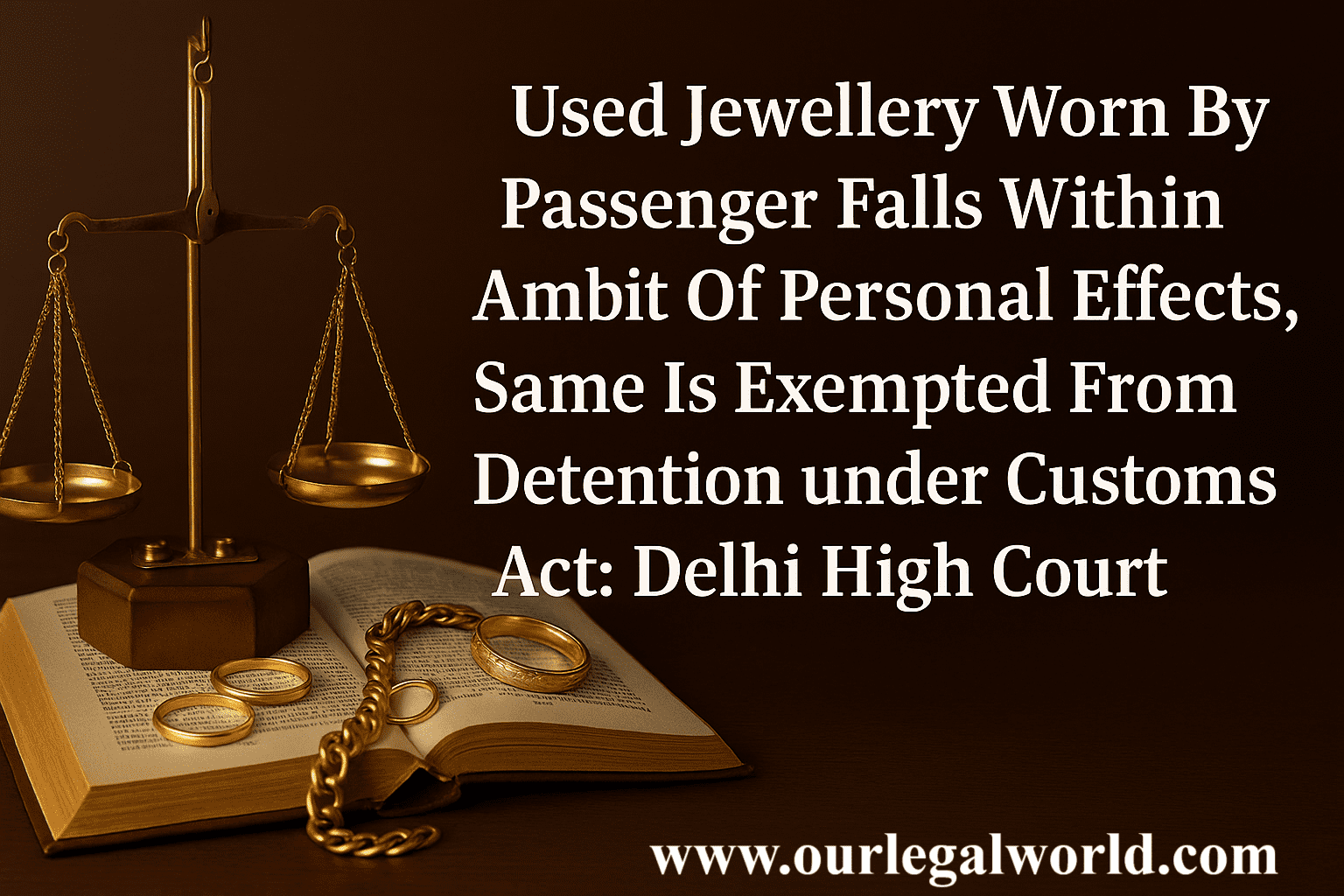

Import or Export of goods/gold through illicit mode from one country to another in order to be evasion from paying taxes or customs duty and in order to overcome restriction imposed on import and export is called smuggling. Customs lawyers play a very important role in handling cases related to gold smuggling by providing legal representation and advice to individuals or entities facing charges or investigations. After seized of gold Customs Advocate role become very crucial, that the goods was seized under section 110 of Customs Act, 1962. That the gold smuggling does not only violate the customs law of the land but alos violate the various other rules osinternational trade, and foregin trade policy etc. The Customs lawyers may need to navigate complex international laws and treaties. They should be knowledgeable about both domestic and international regulations governing the trade of precious metals. The customs law procedure is also different from other sets of laws. For handling customs violation cases, advocates must be familiar with the customs law.

Conclusion:

The Customs Act, 1962, serves as a robust legal framework for combating gold smuggling cases in India. The legislation, combined with effective enforcement and collaboration between various agencies, plays a crucial role in deterring and prosecuting those involved in illicit activities related to the import and export of gold. The continuous evolution of strategies and technology is essential to stay ahead of sophisticated smuggling networks and to protect the economic and security interests of the nation.

Note:

The content provided on this legal blog is intended for informational purposes only and should not be construed as legal advice. The information presented on this blog is not a substitute for professional legal advice or services, and readers should not act upon this information without seeking appropriate legal counsel.

![Tax Law Internship at Legum Attorney [Chamber of Ashish Panday], Delhi : Apply by 15th May 2025](https://www.ourlegalworld.com/wp-content/uploads/2025/05/IMG_0113-min.png)